Unlocked

This plan focuses on greater flexibility by offering access to your retirement savings after leaving ACC. Keeping money invested is great, but so is the ability to take it out if you choose.

Unlocked withdrawals after leaving ACC

Withdraw from your unlocked retirement savings after leaving ACC, no matter your age or how long you’ve been a member.

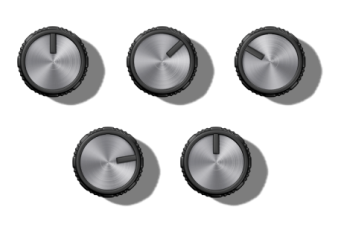

0% contribution is required

Choose your own contribution rate around your personal life and goals. You can choose 0%, or anywhere between 3% and 70% (in multiples of 1%).

Change your plan to locked at any time

You can start making a locked contribution at any time by changing to one of the locked plans offered (Part Locked or Locked).

Optional life and Income Protection insurance

Add on an optional life and income protection insurance bundle with premiums paid from contributions to your unlocked mysuper account.

Not eligible for Government contributions

Unlocked contributions do not comply with the KiwiSaver Act 2006 that offers this benefit.

Not eligible for a first homebuyer withdrawal or grant

Unlocked contributions do not comply with the KiwiSaver Act 2006 that offers this benefit.

What would Unlocked look like for you?

| Fortnightly | Annually | |

|---|---|---|

| Your contributions | $0.00 | $0.00 |

| Locked | $0.00 | $0.00 |

| Unlocked | $0.00 | $0.00 |

| ACC's contributions | $0.00 | $0.00 |

| Locked | $0.00 | $0.00 |

| Unlocked | $0.00 | $0.00 |

| - Less ESCT | -$0.00 | -$0.00 |

| Govt contributions | $0.00 | $0.00 |

| YOUR TOTAL CONTRIBUTIONS: | $0.00 | $0.00 |

All mysuper plans include:

Being 100% member owned and not for profit, mysuper fees are consistently low and you’ll only be charged what your account costs to manage, nothing more.

Choose to contribute anything between 3% and 70% (in multiples of 1%) of your salary to help reach your investment goals, making changes up and down, as needed.

Choose your funds around how many risks or decisions you feel comfortable making and adjust your investment strategy via your mysuper account at any time.

Once you’re a member you have the choice to stay in mysuper even after leaving ACC, keeping your investment options open.

What does this mean for your KiwiSaver?

mysuper is a great way to diversify your investment portfolio, and it can work alongside KiwiSaver as the schemes are independent of each other.

The contribution you make to each scheme is up to you, and the rate you choose for mysuper won’t impact what you already have set up with KiwiSaver.

On joining mysuper, ACC’s 9% contribution will automatically be sent to your mysuper account.

Join 7 out of 10 ACC staff already in mysuper

If you know how you’d like to set up your account, and are ready to join, please complete the following application form to share your selections with us.

|

Can I change my contribution at any time?

|

|

Yes, you can adjust your contribution up or down, or pause it if you wish at any time using the appropriate contribution change form. |

|

Can I change my plan anytime?

|

|

Yes. You can change to one of the locked plans at any time. Once you make a locked contribution you will only be able to adjust your plan between Locked and Part Locked. A change back to the Unlocked plan is not permitted. |

|

How can I stop my contribution to KiwiSaver?

|

|

If you do need to pause your contribution to KiwiSaver you can complete a savings suspension with your provider. |

|

How much will ACC contribute?

|

|

ACC will contribute 9% (before tax) of your salary to your mysuper investment, no matter what you contribute.* This is on top of your salary and taxed in line with personal income tax. * An automatic 9% contribution does not apply to an employee who has signed a non-R3 Employment Agreement which is limited to some staff employed prior to 2014 or within the ACC Investment team. Some rules apply. |

|

Can I make a withdrawal from my unlocked retirement savings at any time?

|

|

A withdrawal from your unlocked retirement savings is possible once you have left ACC to meet the rules of the mysuper Trust Deed. It doesn’t matter how long you were a mysuper member. |

|

Can I transfer my KiwiSaver to mysuper?

|

|

No. The KiwiSaver Act 2006 doesn't permit a transfer as mysuper is not a registered KiwiSaver Scheme. mysuper operates under a Trust Deed, and voluntarily chooses to comply with the KiwiSaver Act 2006 to access the key features offered, while KiwiSaver operates solely under the KiwiSaver Act 2006. If mysuper was a registered KiwiSaver Scheme unlocked contributions would not be available to mysuper members. |

|

Is unlocked money invested differently to locked money?

|

|

No. All contributions, whether unlocked or locked, have the same investment returns applied. The investment strategy you select is what determines the returns you receive. |