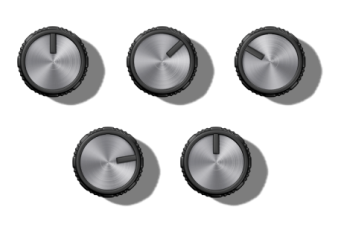

Locked

This plan focuses on the long-term and offers access to Government contributions and a first homebuyer withdrawal by complying with the KiwiSaver Act 2006. Access to your retirement savings is possible after leaving ACC and reaching the New Zealand retirement age (currently 65).

Minimum 3% contribution required

Your own contribution must be a minimum of 3%, or any amount above that up to 70% (in multiples of 1%). All contributions made by you and ACC are locked to meet the requirements of the KiwiSaver Act 2006.

Locked withdrawals after 65

Withdraw from your locked retirement savings after leaving ACC and reaching the New Zealand retirement age (currently 65).

Eligible for a first homebuyer withdrawal and grant

After three years of making locked employee contributions, you may be able to withdraw from your locked retirement savings to put a deposit towards buying your first home (some rules apply).

Eligible for Government contributions

Make your own locked employee contribution of $1,042.86 annually to your locked mysuper account to qualify for the maximum Government contribution of $521.43.

Ability to change your plan to Part Locked

You can change your plan to Part Locked at any time (some rules apply). A change to Unlocked is not permitted once a locked contribution has been made.

Not eligible for Optional Life and Income Protection insurance

Premiums for this cover are paid from unlocked contributions in a mysuper account. This plan does not have any unlocked contributions.

What would Locked look like for you?

| Fortnightly | Annually | |

|---|---|---|

| Your contributions | $0.00 | $0.00 |

| Locked | $0.00 | $0.00 |

| Unlocked | $0.00 | $0.00 |

| ACC's contributions | $0.00 | $0.00 |

| Locked | $0.00 | $0.00 |

| Unlocked | $0.00 | $0.00 |

| - Less ESCT | -$0.00 | -$0.00 |

| Govt contributions | $0.00 | $0.00 |

| YOUR TOTAL CONTRIBUTIONS: | $0.00 | $0.00 |

All mysuper plans include:

Being 100% member owned and not for profit, mysuper fees are consistently low and you’ll only be charged what your account costs to manage, nothing more.

Choose to contribute anything between 3% and 70% (in multiples of 1%) of your salary to help reach your investment goals, making changes up and down, as needed.

Choose your funds around how many risks or decisions you feel comfortable making and adjust your investment strategy via your mysuper account at any time.

Once you’re a member you have the choice to stay in mysuper even after leaving ACC, keeping your investment options open.

What does this mean for your KiwiSaver?

mysuper is a great way to diversify your investment portfolio, and it can work alongside KiwiSaver as the schemes are independent of each other.

The contribution you make to each scheme is up to you, and the rate you choose for mysuper won’t impact what you already have set up with KiwiSaver.

On joining mysuper, ACC’s 9% contribution will automatically be sent to your mysuper account.

Join 7 out of 10 ACC staff already in mysuper

If you know how you’d like to set up your account, and are ready to join, please complete the following application form to share your selections with us.

|

Can I change my contribution at any time?

|

|

Yes, you can adjust your contribution up or down (minimum 3%) if you wish at any time using the appropriate contribution change form. When making a locked contribution you are required to do so under the rules of the KiwiSaver Act 2006 for 12-months before you can pause your contribution. |

|

Can I change my plan anytime?

|

|

Some rules apply as locked contributions follow the KiwiSaver Act 2006. Once you make a locked contribution you will only be able to adjust your plan between Locked and Part Locked. A change back to the Unlocked plan is not permitted. |

|

How can I stop my contribution to KiwiSaver?

|

|

If you do need to pause your contribution to KiwiSaver you can complete a savings suspension with your provider. |

|

How much will ACC contribute?

|

|

ACC will contribute 9% (before tax) of your salary to your mysuper investment, no matter what you contribute.* This is on top of your salary and taxed in line with personal income tax. * An automatic 9% contribution does not apply to an employee who has signed a non-R3 Employment Agreement which is limited to some staff employed prior to 2014 or within the ACC Investment team. Some rules apply. |

|

Can I make a withdrawal from my locked retirement savings at any time?

|

|

A withdrawal from your locked retirement savings is possible once you have reached the NZ Retirement age (currently 65) to meet the rules of the KiwiSaver Act 2006. Some exceptions exist for an early withdrawal to be made but they are limited. The most common is a First homebuyer withdrawal. |

|

How can I find out more about making a first homebuyer withdrawal with mysuper?

|

|

We have a dedicated First homebuyer withdrawal section to help guide our members through eligibility, getting prepared and making the withdrawal when the time comes. It also provides information around the first home grant offered by Kāinga Ora. |

|

Does a first homebuyer withdrawal work the same for mysuper as it does with KiwiSaver?

|

|

Yes. Locked contributions comply with the KiwiSaver Act 2006 which provides access to a first homebuyer withdrawal. You can learn more about that in our first homebuyer section. |

|

Can I get a Government contribution from mysuper and KiwiSaver at the same time?

|

|

No. The Government contribution is awarded per person not per scheme. If you contribute to more than one scheme that complies with the KiwiSaver Act 2006, the one that requests this on your behalf first is where it will be applied. |

|

Can I transfer my KiwiSaver to mysuper?

|

|

No. Although we'd love to accept your transfer, the KiwiSaver Act 2006 doesn't permit it as is not a registered KiwiSaver Scheme. mysuper operates under a Trust Deed, and voluntarily chooses to comply with the KiwiSaver Act 2006 to access the key features offered, while KiwiSaver operates solely under the KiwiSaver Act 2006. If mysuper was a registered KiwiSaver Scheme ‘unlocked’ contributions would not be available to mysuper members. |

|

Is locked money invested differently to unlocked money?

|

|

No. All contributions, whether unlocked or locked, have the same investment returns applied. The investment fund you select is what determines the returns you receive. |